Sell a House With Sold Property Taxes in Chicagoland

A simple, as-is solution for properties with sold taxes, back taxes, or tax sale pressure — without repairs, listings, or unnecessary delays.

Dealing With Sold Property Taxes in Chicagoland? You Have Options

Falling behind on property taxes can happen faster than most homeowners expect. Missed payments, rising tax bills, or financial hardship can lead to sold property taxes and the risk of losing the home if the situation isn’t resolved in time.

In Chicagoland, tax issues can quickly become overwhelming — especially when penalties, interest, and deadlines continue to pile up. Listing the home often isn’t realistic when time is limited or the property needs repairs.

For many owners, choosing to sell the house as-is provides a way to stop the situation from escalating and move forward with clarity.

If the property is also inherited, tenant-occupied, or tied to other financial pressure, you may want to explore those options as well:

Inherited rental? See: Sell an inherited house

Rental or tenant issues? See: Sell a problem rental

Facing deadlines or hardship? See: Avoid foreclosure

Why Many Owners Choose to Sell a House With Sold Taxes As-Is

When property taxes are sold, time matters. Many owners don’t want to invest more money into a property they may not be able to keep, especially if repairs or cleanouts are needed.

Selling as-is allows owners to focus on resolution instead of continuing to chase a growing problem.

Owners often choose an as-is sale because it allows them to:

Avoid making repairs or updates

Skip listings, showings, and open houses

Stop penalties, interest, and mounting stress

Sell even if the home is outdated or vacant

Resolve the situation privately and efficiently

This approach is designed to reduce pressure and give you a clear exit path.

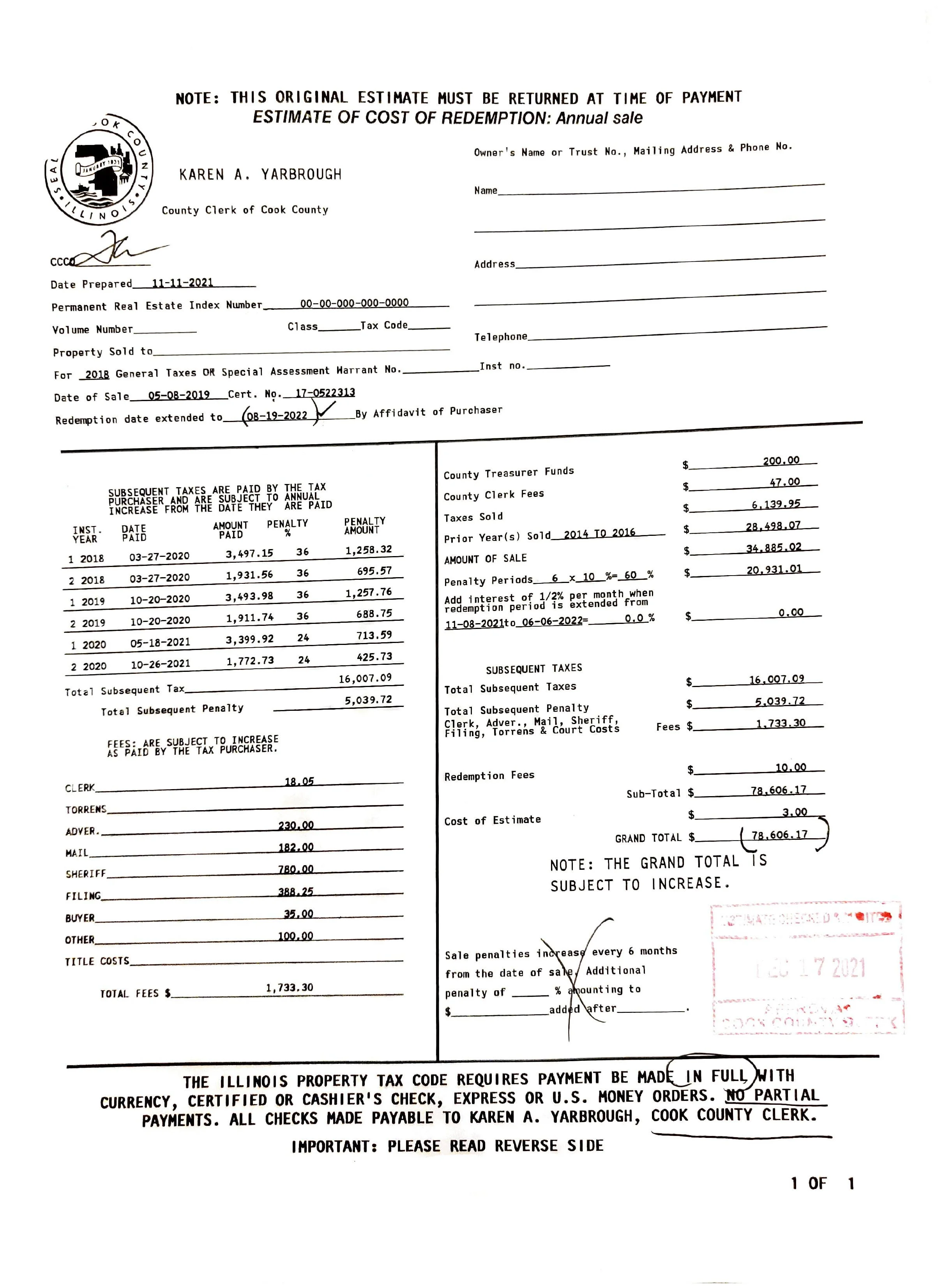

What Does It Mean When Property Taxes Are Sold?

When property taxes go unpaid, the taxing authority may sell the tax debt to a third party. This doesn’t always mean immediate loss of the property, but it does create deadlines and added costs that must be addressed.

In many situations, homeowners still have options, including selling the property before the situation gets worse.

We commonly help owners dealing with:

Sold property taxes or tax sale notices

Multiple years of back taxes

Vacant or distressed properties

Homes that need repairs or cleanouts

Owners who want a private, off-market sale

We work closely with local Chicagoland title companies and understand how these situations are typically handled during a sale.

We don’t provide legal advice — but before you spend more money trying to catch up on taxes or rush into a listing, we can help you understand your realistic options and timeline.

If you’re unsure how serious the tax situation is, submit the property details and we’ll help you understand your options — confidentially and without obligation.

How It Works

Contact Us Confidentially

Tell us about the property, its condition, and your goals.

We Give You a Fair Cash Offer

No repairs or tenant removal required.

Close & Move On Your Timeline

Close through a local title company on a timeline that works for your family

We’re a local Chicagoland buyer and have completed dozens of purchases. We buy with our own funds and private money, which allows us to move quickly when needed.

If time is critical, we may be able to close in as little as 7 days. If you need more time, we can work around your situation.

Tax issues often overlap with other challenges. If any of these apply, you may find these pages helpful:

Related Situations We Help With

Selling a House With Sold Property Taxes in Chicagoland — FAQs

Can I sell a house if the property taxes are sold?

Yes. In many cases, properties with sold taxes can still be sold. The details depend on timing and title requirements, but sold taxes do not automatically prevent a sale.

Do I need to pay off the taxes before selling?

Not always. In some situations, taxes can be addressed through the closing process. We can help explain what’s typically required.

How much time do I have after taxes are sold?

Timelines vary depending on the situation. The important thing is to understand where you stand sooner rather than later so you can make an informed decision.

What if the house also needs repairs or is vacant?

That’s very common. Many properties with tax issues are sold as-is, without making repairs or updates.

Can I sell a house with multiple years of back taxes?

Yes. Multiple years of back taxes don’t automatically prevent a sale. These situations are more common than many owners realize.

How fast can a house with sold taxes close?

Once title requirements are clear, closings often happen within a few weeks. If timing is critical, we may be able to close in as little as 7 days.